Cornerstone and M Financial

Making the Difference for Affluent Families and Individuals

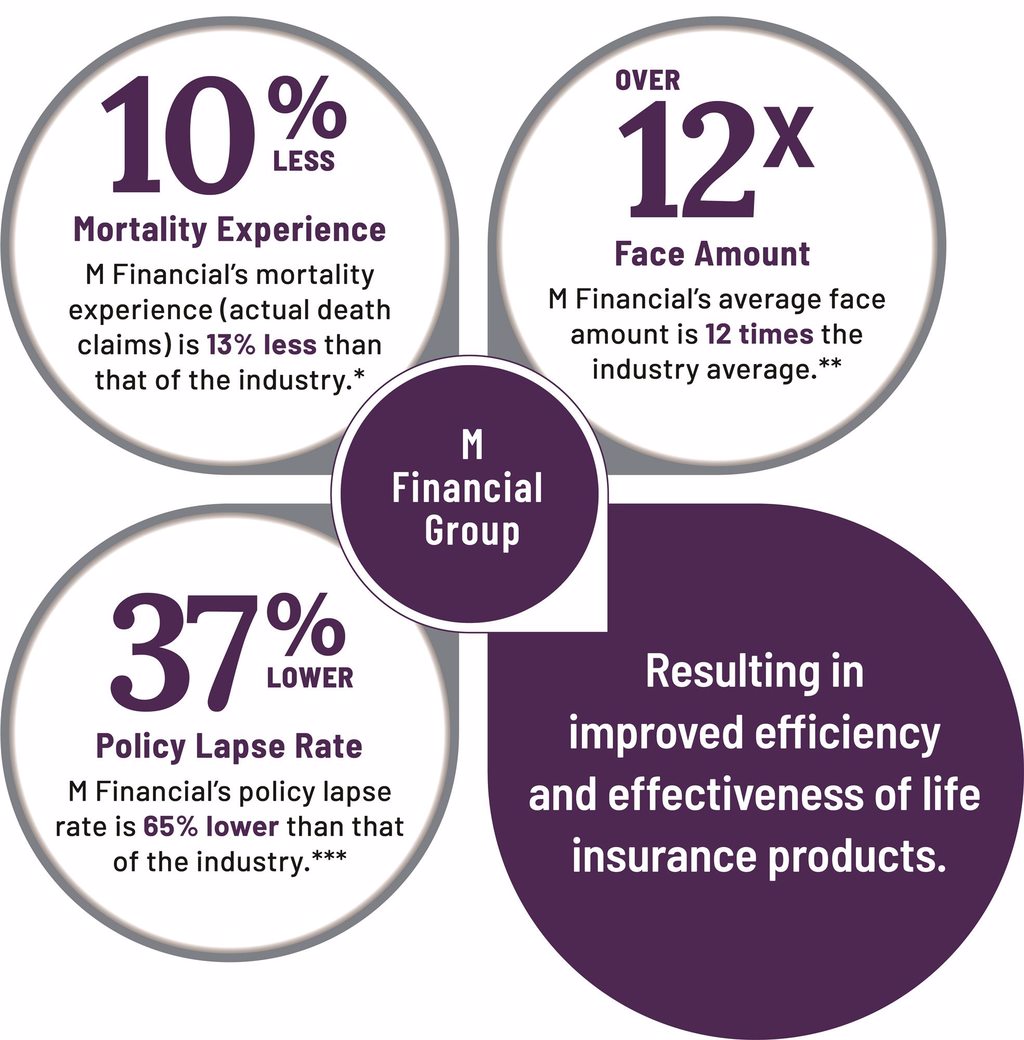

Cornerstone and M Financial offer collective buying power and superior experience in mortality, persistence, and policy size that results in exclusive pricing for our proprietary products for our clients.

A Service for a Select Few

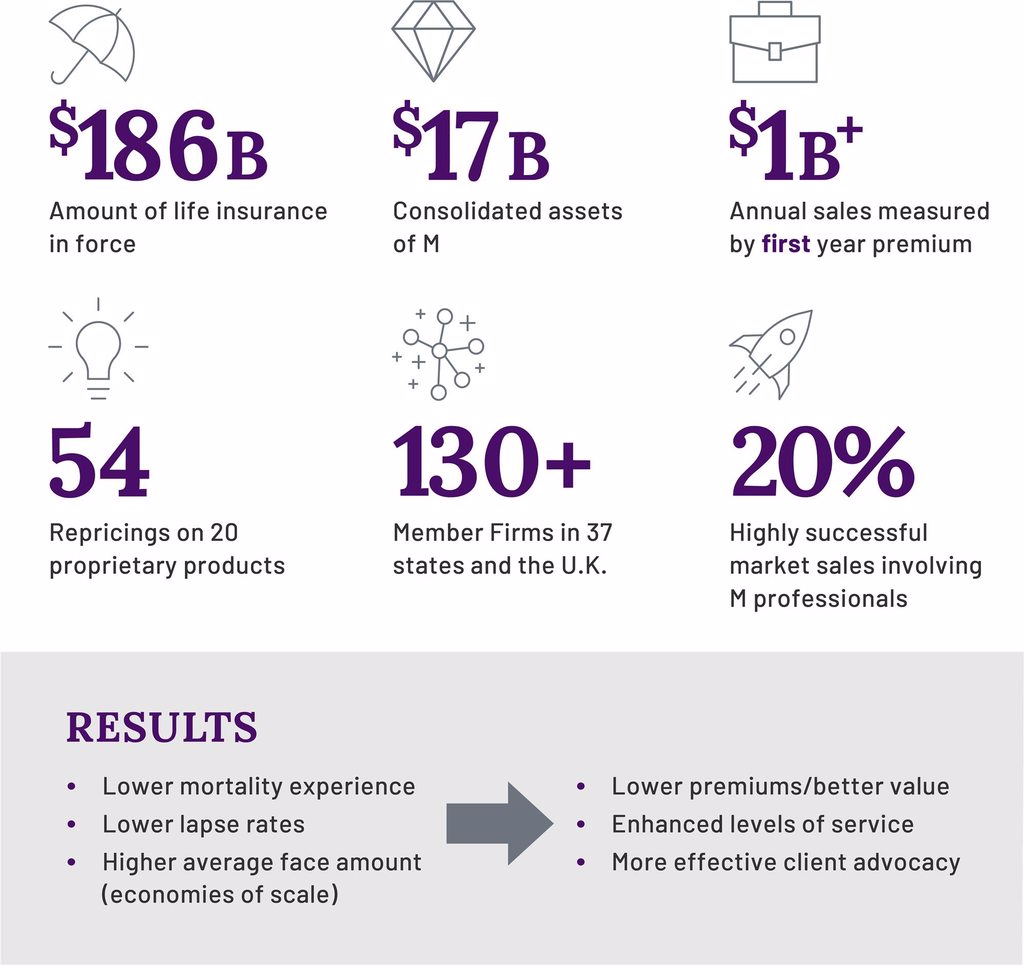

Cornerstone is part of an exclusive network of 130+ M Financial firms serving the U.S., Canada, and the U.K.

M Financial Group is one of the nation’s premier financial services design and distribution companies serving the affluent and corporate markets.

The experience of more than 270 financial professionals

As a member of M Financial Group, Cornerstone leverages the experience and specialization of not only our own seasoned insurance professionals but also that of more than 270 M Financial professionals, including accountants, underwriters, insurance product development and management professionals and more than 17 full-time actuaries, to support the needs of our clients.

Our Unique Relationship with Carriers Means Better Products for Less

M Financial Group underwrites 43 percent of all insurance policies for affluent individuals. With a face amount of $186 billion in policies currently in force, representing a cash value of $44 billion, M Financial works closely with its partner-carriers to design and develop products that meet the specific needs of affluent clients and also negotiates with carriers on behalf of those clients.

Products designed specifically for affluent clients

- More than 25 proprietary products from six partner carriers

- Designed and priced using M Financial’s unique persistency, face amount, and mortality experience

- M mortality experience (actual death claims), is 10% less than the industry high-net-worth segment, lowering the cost of M proprietary life insurance products

- Affluent customers like you have more time to take care of their health, receive better healthcare, and live longer than the general population. Why should you pay the same rates?

- M policies are seven times the average face value nationally, lowering premiums for our clients

- The lapse/surrender rate of M Financial’s proprietary products is nearly 37% lower than that of the industry, driving policy fees lower

- M Financial proprietary insurance products are reinsured by M Financial Re, which invests in excess of $50 million a year in the business placed by M Financial Group member firms